Les journalistes osent rarement se lancer dans des pronostics pessimistes, notamment en France. Je me suis apperçu ces dernières semaines que les médias anglo-saxons parlent de plus en plus ouvertement de ce qui semble désormais évident: les Etats-Unis sont entrés dans l'une des pires recessions de leur histoire et celle-ci marquera la fin de l'ère de l'"hyperpuissance".

Pour une analyse plus technique des processus en cours voir "Après 87, la recession américaine, la même...en pire!".

Nous reproduisons ici l'intégralité de l'article de The Economist du 15 Novembre. Pour les non anglophones ContreInfo propose un résumé en Français.

"Recession in America looks increasingly likely. Can booming emerging markets save the world economy?

IN 1929, days after the stockmarket crash, the Harvard Economic

Society reassured its subscribers: “A severe depression is outside the

range of probability”. In a survey in March 2001, 95% of American

economists said there would not be a recession, even though one had

already started. Today, most economists do not forecast a recession in

America, but the profession's pitiful forecasting record offers little

comfort. Our latest assessment (see article) suggests that the United States may well be heading for recession.

IN 1929, days after the stockmarket crash, the Harvard Economic

Society reassured its subscribers: “A severe depression is outside the

range of probability”. In a survey in March 2001, 95% of American

economists said there would not be a recession, even though one had

already started. Today, most economists do not forecast a recession in

America, but the profession's pitiful forecasting record offers little

comfort. Our latest assessment (see article) suggests that the United States may well be heading for recession.

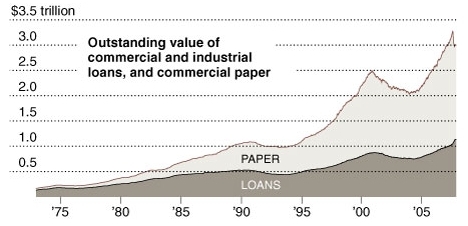

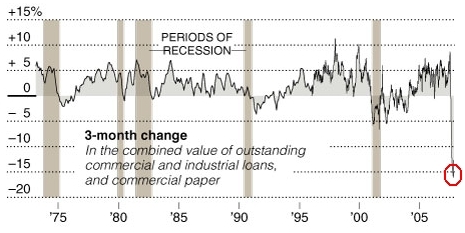

Granted, GDP grew by a robust 3.9%, at an

annual rate, in the third quarter. Granted also, revisions may well

push this figure up. But that was the past. More timely signs suggest

that the economy could stall in this quarter. By early next year,

output and jobs could be shrinking. The main cause is the imploding

housing market. Experts said that house prices could never fall

nationwide. But fall they have, by 5% in the past 12 months.

Residential investment has collapsed, but a glut of unsold homes means

that prices have much further to drop. Americans' spending is likely to

be dented much more by a fall in house prices than it was in 2001 by

the stockmarket's collapse. With house prices lower and credit

conditions tighter as a result of the subprime crisis, households can

no longer borrow against capital gains to support their spending.

Dearer oil is set to squeeze households further (this week's drop

in crude prices notwithstanding). Consumer confidence has already

fallen sharply. It cannot be long before consumer spending stumbles,

which in turn would hurt companies' profits and investment. The weak

dollar will boost exports, but at only 12% of GDP, exports are too small to make up for a weakening of consumer spending, which accounts for 70%.

I want to break free

Will an American recession drag the rest of the world down with it?

The economies of Europe and Japan rebounded strongly in the third

quarter, but look likely to slow down. Although both should be able to

keep chugging along, neither is likely to set any great pace.

Strengthening currencies will hurt exporters in both places. Europe's

own housing hotspots are cooling, and some of its banks have been

sideswiped by America's subprime ills.

The best hope that global growth can stay strong lies instead with

emerging economies. A decade ago, the thought that so much depended on

these crisis-prone places would have been terrifying. Yet thanks

largely to economic reforms, their annual growth rate has surged to

around 7%. This year they will contribute half of the globe's GDP

growth, measured at market exchange rates, over three times as much as

America. In the past, emerging economies have often needed bailing out

by the rich world. This time they could be the rescuers.

Of course, a recession in America would reduce emerging economies'

exports, but they are less vulnerable than they used to be. America's

importance as an engine of global growth has been exaggerated. Since

2000 its share of world imports has dropped from 19% to 14%. Its vast

current-account deficit has started to shrink, meaning that America is

no longer pulling along the rest of the world. Yet growth in emerging

economies has quickened, partly thanks to demand at home. In the first

half of this year the increase in consumer spending (in actual dollar

terms) in China and India added more to global GDP growth than that in America.

Most emerging economies are in healthier shape than ever (see article).

They are no longer financially dependent on the rest of the world, but

have large foreign-exchange reserves—no less than three-quarters of the

global total. Though there are some notable exceptions, most of them

have small budget deficits (another change from the past), so they can

boost spending to offset weaker exports if need be.

This does not mean emerging economies will grow fast enough to make

up for the whole of a fall in America's output. Most of them will slow

a bit next year: for instance, China's growth rate may dip to “only”

10%. So global growth will ease—which, after five years at an average

of almost 5%, close to its fastest pace ever, it needs to do. But

thanks to the vigour of the new titans, it will stay above its 30-year

average of 3.5%.

A tale of two prices

The rising importance of the world's new giants will not only boost

growth. It will also shift relative prices, notably those of oil and

the dollar. And the consequences of this will be less comfortable for

developed countries, especially America.

The oil price has risen mainly because of strong demand in emerging

economies, which have accounted for as much as four-fifths of the total

increase in oil consumption in the past five years. In past American

recessions the oil price usually fell. This time it is likely to hold

up. That will not only hurt the finances of Western consumers, but may

also make the jobs of their central bankers harder, by combining

inflationary pressure with economic slowdown.

The enfeebled dollar—lately in sight of $1.50 to the euro—would be

weaker still without enormous purchases by central banks in emerging

economies. This support is now waning. China and others are putting a

smaller share of increases in reserves into the American currency. And

Asian and Middle Eastern countries with currencies linked to the dollar

are facing rising inflation, but falling American interest rates make

it harder to tighten their own monetary policy. They may have to let

their currencies rise against the sickly greenback, meaning they will

need to buy fewer dollars. More important, as international investors

wake up to the relative weakening of America's economic power, they

will surely question why they hold the bulk of their wealth in dollars.

The dollar's decline already amounts to the biggest default in history,

having wiped far more off the value of foreigners' assets than any

emerging market has ever done.

The vigour of emerging economies is good news for the world

economy: for its growth, it has much less need of a strong America. The

bad news for America is that this, in turn, may mean that the world

also has less need of the dollar".

Nov 15th 2007

From The Economist(R) print edition

Une bonne blague à lire ce matin sur Bloomberg :

Une bonne blague à lire ce matin sur Bloomberg :

"C'est le nouveau thème dominant des commentaires sur l'économie du monde : l'inflation menace. Aux Etats-Unis, la Réserve fédérale relève que les prix ont dérapé de 2,8 % sur la dernière période annuelle glissante. En Europe, la BCE anticipe jusqu'à la fin de 2008 une dérive nettement supérieure aux 2 % considérés comme le plafond acceptable. Or elle s'accompagne de perspectives moroses et d'une croissance molle, d'à peine 2 %, selon la plupart des projections. Sans aller jusqu'à évoquer une nouvelle stagflation (combinaison d'inflation et de stagnation), on est conduit à diagnostiquer un dérèglement sournois des repères monétaires sans dynamique économique. On ne classerait pas non plus celle-ci dans la catégorie des inflations par la demande, notamment aux Etats-Unis et en Allemagne, ni dans celle, domestique, des inflations par les coûts, principalement salariaux. Et, pourtant, elle roule. Le paradoxe apparent est qu'elle nous vient de la libération mondiale des échanges, laquelle est censée, au contraire, faire pression sur les prix grâce à la concurrence exercée par les nouveaux producteurs. Dans ce nouveau puzzle, il faut analyser.

"C'est le nouveau thème dominant des commentaires sur l'économie du monde : l'inflation menace. Aux Etats-Unis, la Réserve fédérale relève que les prix ont dérapé de 2,8 % sur la dernière période annuelle glissante. En Europe, la BCE anticipe jusqu'à la fin de 2008 une dérive nettement supérieure aux 2 % considérés comme le plafond acceptable. Or elle s'accompagne de perspectives moroses et d'une croissance molle, d'à peine 2 %, selon la plupart des projections. Sans aller jusqu'à évoquer une nouvelle stagflation (combinaison d'inflation et de stagnation), on est conduit à diagnostiquer un dérèglement sournois des repères monétaires sans dynamique économique. On ne classerait pas non plus celle-ci dans la catégorie des inflations par la demande, notamment aux Etats-Unis et en Allemagne, ni dans celle, domestique, des inflations par les coûts, principalement salariaux. Et, pourtant, elle roule. Le paradoxe apparent est qu'elle nous vient de la libération mondiale des échanges, laquelle est censée, au contraire, faire pression sur les prix grâce à la concurrence exercée par les nouveaux producteurs. Dans ce nouveau puzzle, il faut analyser.

Les commentaires récents